|

| YouTube Creators/Google AdSense account owners are given a deadline: ©Provided by Bodopress/Rwnchang |

YouTubers, vloggers, bloggers, website or app owners who run YouTube channel(s) earning majority of their income from an audience located in the United States (U.S.) will probably experience a reduction in their revenue later this year. According to Chapter 3 of the U.S. Internal Revenue Code Google is required to collect tax info from all monetizing YouTube creators living outside United States and deduct taxes. This tax will be as high as 30% and minimum 15% deducted from your total YouTube revenue.

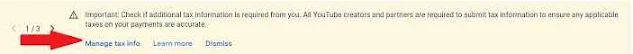

by May 31, 2021 YouTube creators/Google AdSense account owners should provide a valid tax information (tax forms will be renewed each year afterwards) from June 01, 2021 Google/YouTube will start collecting U.S. withholding tax from all accounts if applicable.

The following is Google Announcement letters:-

Hi there,

We’re reaching out because Google will be required to deduct U.S. taxes from payments to creators outside of the U.S. later this year (as early as June 2021). Over the next few weeks, we’ll be asking you to submit your tax info in AdSense to determine the correct amount of taxes to deduct, if any apply. If your tax info isn’t provided by May 31, 2021, Google may be required to deduct up to 30% of your total earnings worldwide.

What do I need to do?

In the next few weeks you will receive an email to submit your tax information in AdSense. The online tax tool in AdSense is six steps and will ask you a series of questions to guide you through the process to determine if any U.S. taxes apply. For more information on these changes and a list of tax info to prepare, visit our Help Center.

Why is this happening?

Google has a responsibility under Chapter 3 of the U.S. Internal Revenue Code to collect tax info from all monetizing creators outside of the U.S. and deduct taxes in certain instances when they earn income from viewers in the U.S.

For creators outside of the U.S., we will soon be updating our Terms of Service where your earnings from YouTube will be considered royalties from a U.S. tax perspective. This may impact the way your earnings are taxed, and as required by U.S. law, Google will deduct taxes.

How will my earnings be impacted?

If you provide your tax info, U.S. taxes may only be applied to your monthly U.S. earnings from AdSense (revenue earned from viewers in the U.S. through ad views, YouTube Premium, Super Chat, Super Stickers, and Channel Memberships). If no tax info is provided, your tax rate will default to the higher individual backup withholding rate (24% of total earnings worldwide). To estimate the potential impact on your earnings follow these instructions.

Thanks,

The YouTube Team

In addition, TeamYouTube tweeted further explanation about what is going on:

TeamYouTube via Twitter

“For creators outside of the U.S., we’ll be updating our TOS, where earning from YouTube will be considered royalties from a US tax perspective. This may impact the way earnings are taxed and as required by US law, Google will need to withhold taxes”

Now you can be fill on your Google adsense accounts for decrease to Minimum Tax 15% by given your information. Otherwise your Tax will be deducted 30% of your Revenue.

Post a Comment

Thanks for messaging us. If you have any doubts. Please let me know.